Cyber Week 2022 Holiday Shopping Trends: Thanksgiving and Black Friday

Written by

Pablo Gallaga

Cyber Week 2022 Holiday Shopping Trends: Thanksgiving and Black Friday

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

As expected, this holiday season is shaping up to be a big one.

Despite the consensus that sales growth would slow this holiday season due to inflation, analysts and experts still predicted yet another year of record-breaking holiday sales. The National Retail Federation (NRF) projected U.S. holiday sales to grow between 6 and 8% year-over-year (YoY) to a record between $942.6 billion and $960 billion compared to the 13.5% growth seen in 2021.

And while the holiday shopping season seems to start earlier every year — BigCommerce merchants began seeing spikes in October — shoppers around the world continue holding out hope for major savings on the traditional big deal days over the U.S. Thanksgiving weekend.

In a survey conducted by Drive Research of over 1,000 U.S. consumers, 80% of respondents said they would be shopping this Cyber Week, the five-day span from Thanksgiving to Cyber Monday.

The data is now rolling in and it confirms that shoppers were out in full force at the start of Cyber Week, exceeding sales expectations and proving predictions of a slowdown missed the mark. Here’s a look at Cyber Week performance so far on Thanksgiving and Black Friday.

Methodology

BigCommerce’s holiday shopping data is based on a comparison of total platform sales that occurred between November 25 – November 26, 2021 and November 24 – November 25, 2022. It represents information from thousands of small, mid-sized and enterprise retailers selling on the BigCommerce platform. Unless otherwise noted, the data is global.

Thanksgiving Online Sales Set a New Record

Thanksgiving Day is an interesting holiday shopping day as many U.S. brick-and-mortar stores now elect to close for the day to allow employees to spend time with their families. This means deals and shopping mostly shift online.

As mobile shopping experiences have improved, U.S. families increasingly find themselves juggling searches for deals with family time. Even with this added convenience, expectations for Thanksgiving 2022 were that sales across the top 100 U.S. ecommerce platforms would decline for the first time since 2015 as a result of deals dropping throughout the year and consumers generally curbing their spending in 2022 because of higher interest rates and inflation.

But as it turns out, consumers didn’t want to wait for Black Friday. Thanksgiving Day sales in the U.S. were up 2.9% YoY, according to Adobe Analytics, setting a record of $5.3 billion. As we mentioned, Thanksgiving isn’t just an interest domestically. Globally, sales increased 1% YoY to $31 billion, according to data from Salesforce.

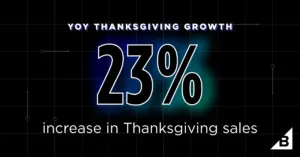

Following the upward trend, BigCommerce stores experienced a significant increase in sales on Thanksgiving Day 2022 compared to 2021. Specifically, Thanksgiving GMV was up just over 23% YoY and total orders were up slightly more than 22% YoY. The average order value (AOV) was nearly 1% higher YoY.

The Biggest Ecommerce Black Friday Ever

Historically known as a day of in-person doorbuster madness, Black Friday ecommerce sales have continued rising over the last several years, largely due to the pandemic-induced ecommerce boom coupled with a declining public interest in braving long queues.

The previously mentioned survey by Drive Research identified that 69% of respondents planned to shop online this Black Friday, while only 32% would shop in person.

Early Black Friday deals were the story this year, with major retailers like Amazon, Walmart and Best Buy releasing discounts on big ticket items throughout October.

The elongated deals season didn’t seem to impact online sales, however, as this year’s Black Friday ecommerce sales crossed the $9 billion mark for the first time and set a record of $9.12 billion.

BigCommerce merchants were a driving force for these big numbers as Black Friday GMV increased almost 31% compared to 2021, bolstered by just over a 25% increase in total orders YoY and a 4.5% increase in AOV YoY.

The Final Word

The results of the first two days of Cyber Week paint a clear picture of what many retailers suspected heading into this holiday season: the landscape has changed dramatically.

And while the holiday season now stretches longer, the traditional Cyber Week shopping days are busier than ever for merchants using the BigCommerce platform, with holiday ecommerce sales still on the rise.

“Given the soft global economy, this year’s peak holiday sales week is more important than ever. With a year-over-year sales increase of 31% on Black Friday and 23% on Thanksgiving, BigCommerce merchants grew significantly faster than overall ecommerce,” said Brent Bellm, Chief Executive Officer at BigCommerce. “Our merchants sell more by taking advantage of BigCommerce’s industry-leading capabilities in customer experience, multi-storefront expansion and omnichannel selling.”

Stay tuned for our full Cyber Week Report coming later this week with data insights from the entire week, including Cyber Monday.