Preparing For The Next Era of Retail: How To Succeed In a World Without COVID-19

Preparing For The Next Era of Retail: How To Succeed In a World Without COVID-19

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

The past six weeks have been inconceivable for retailers around the world. Aside from how our personal lives have changed, businesses are coping with furloughs, supply chain challenges, the shut down of retail stores, and learning to navigate a retail world in a time of social distancing.

Simply put, the spread of COVID-19 has left both non- and essential retail businesses in dismay. For some, government executive orders make difficult decisions for them. Others are doing everything they can to keep their small businesses alive with curbside delivery, takeout options, and focusing on online orders.

As retailers shift their strategies due to the impact of COVID-19, they are quickly adapting to a new set of consumer behaviors and understanding just how vital ecommerce solutions are.

Coronavirus (COVID-19) is Influencing Consumer Spending

A pandemic this impactful will be hard to forget. In the United States, consumers have spent that last 6-8 weeks at home. Some of the nation’s most populated cities, like New York, now have little foot traffic and the noise of bustling streets have been replaced with cheers from the high-rise balconies of locals supporting those on the front lines.

Around the world, consumers’ lives changed nearly overnight, and their spending behavior follows a similar pattern. Data from April 2020, aggregated by Common Thread Collective, visualizes where and how consumers have shifted their spending.

Let’s break down all the factors impacting these behavior shifts.

1. Health and well-being.

The state of public health has left consumers with one thing on their mind: protecting themselves from the novel coronavirus.

Since the beginning of the pandemic, we have seen a sharp rise in purchases for medicines, health items, supplies, cleaning materials, and such.

In the wake of the pandemic, Amazon made sudden changes to their fulfillment program to prioritize these products. In recent weeks, they have begun a phased return to pre-coronavirus operations.

In addition, consumers have quickly shifted from a popular industry trend of just months passed: natural and sustainable products.

Rather than reaching for natural products on the grocery shelves, consumers are spending more on household brands with anti-bacterial power. Some grocers and other retail companies are also banning the use of reusable bags after learning COVID-19 can live on cardboard for up to 24 hours and plastic and metal products for up to 36 hours.

2. Stay-at-home initiatives.

With consumers ordered to stay home around the world and store closures becoming the temporary norm, the retail industry has no choice but to adapt. This has forced retailers to reimagine the customer experience, like restaurants offering curbside delivery for meals — and in states like Texas, even alcoholic beverages.

For consumers, it’s prompted them to purchase products that help them work from home, exercise, pass the time, refresh their living spaces, and keep children entertained.

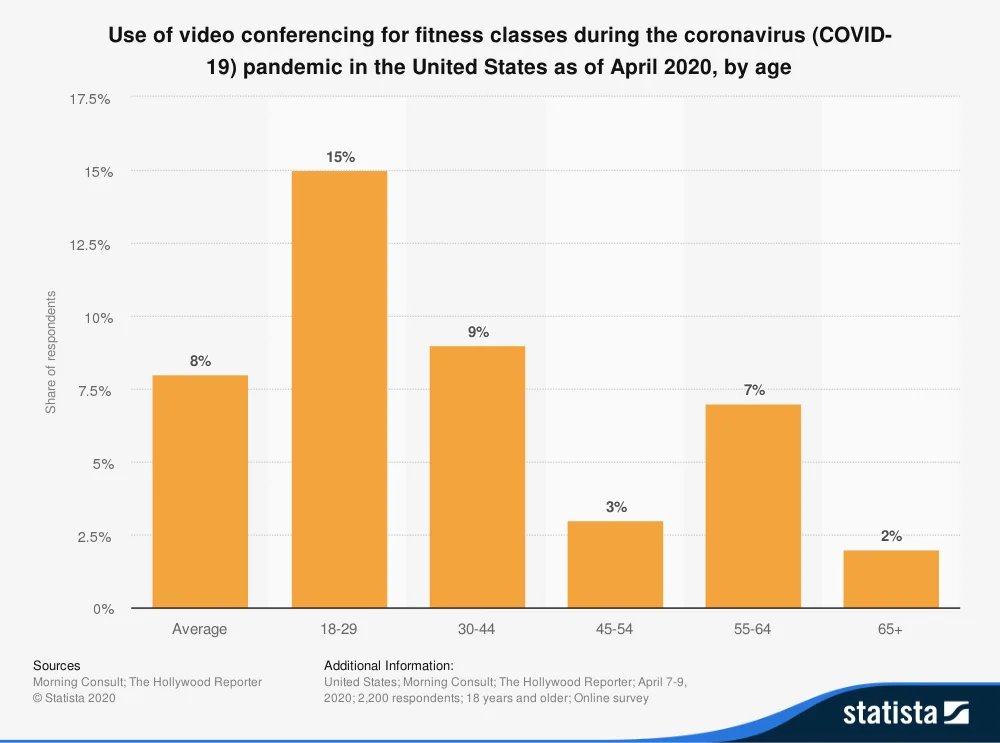

For example, 24% U.S. Gen Z and Millennials are using video conferencing for fitness classes.

Source: Statista

In addition, just a few weeks into the lockdown, Walmart reported they were experiencing an uptick in apparel tops, a signal that those working from home are prioritizing their appearance from the waist up.

3. Increasing unemployment rates and a damaged economy.

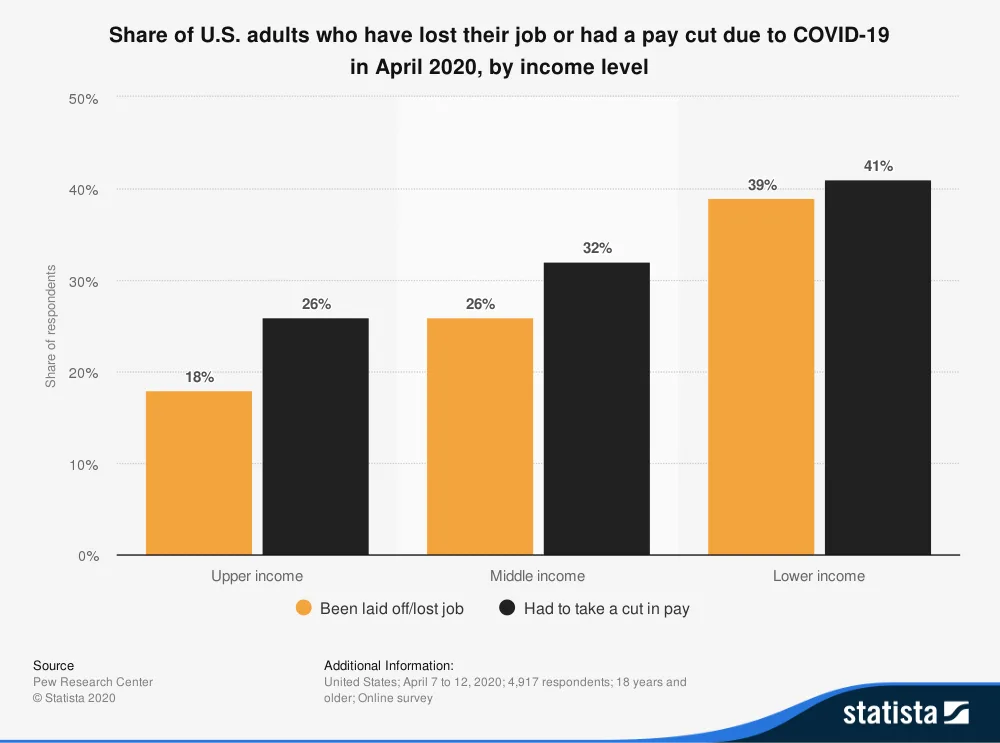

Even though some categories are seeing an upward trend in online sales, consumer purchasing power is on the decline. Many have been laid off or furloughed due to the coronavirus outbreak and, over the past seven weeks, 33.5 million Americans have filed for unemployment insurance.

Source: Statista

In addition to rising unemployment rates, the global economy continues to be impacted by COVID-19. Between direction from the Center For Disease Control (CDC), World Health Organization (WHO), National Institute of Health (NIH), and orders from the White House and around the world, both non- and essential businesses, with or without retail locations, are forced to adapt to a new consumer landscape. This includes how consumers react to new information, the market, and what it means for them.

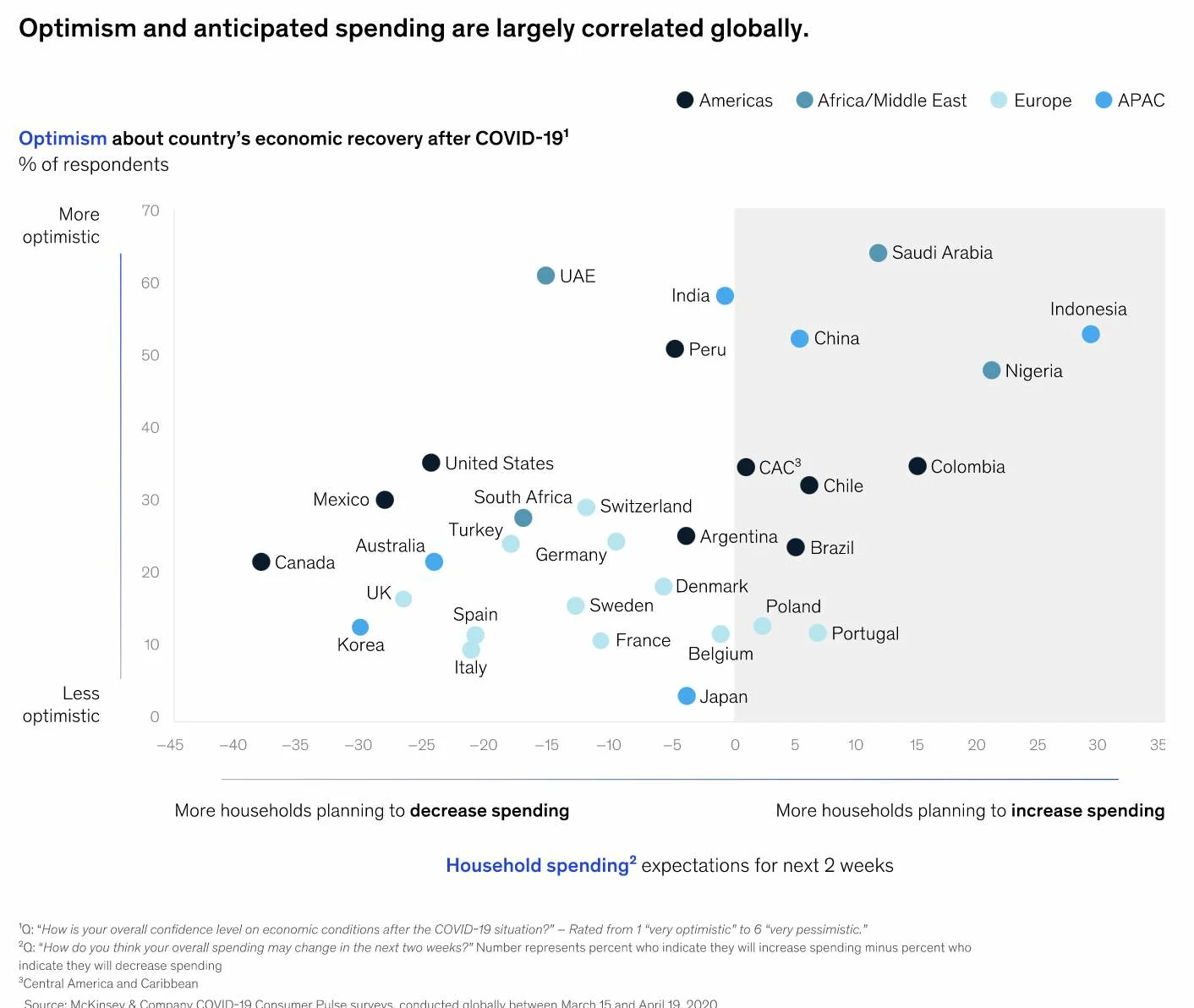

To better understand how consumers are responding to the pandemic, McKinsey and Company gathered data from across the globe on consumer sentiment and behavior. The chart below matches consumer optimism with spending behavior.

Source: McKinsey and Company

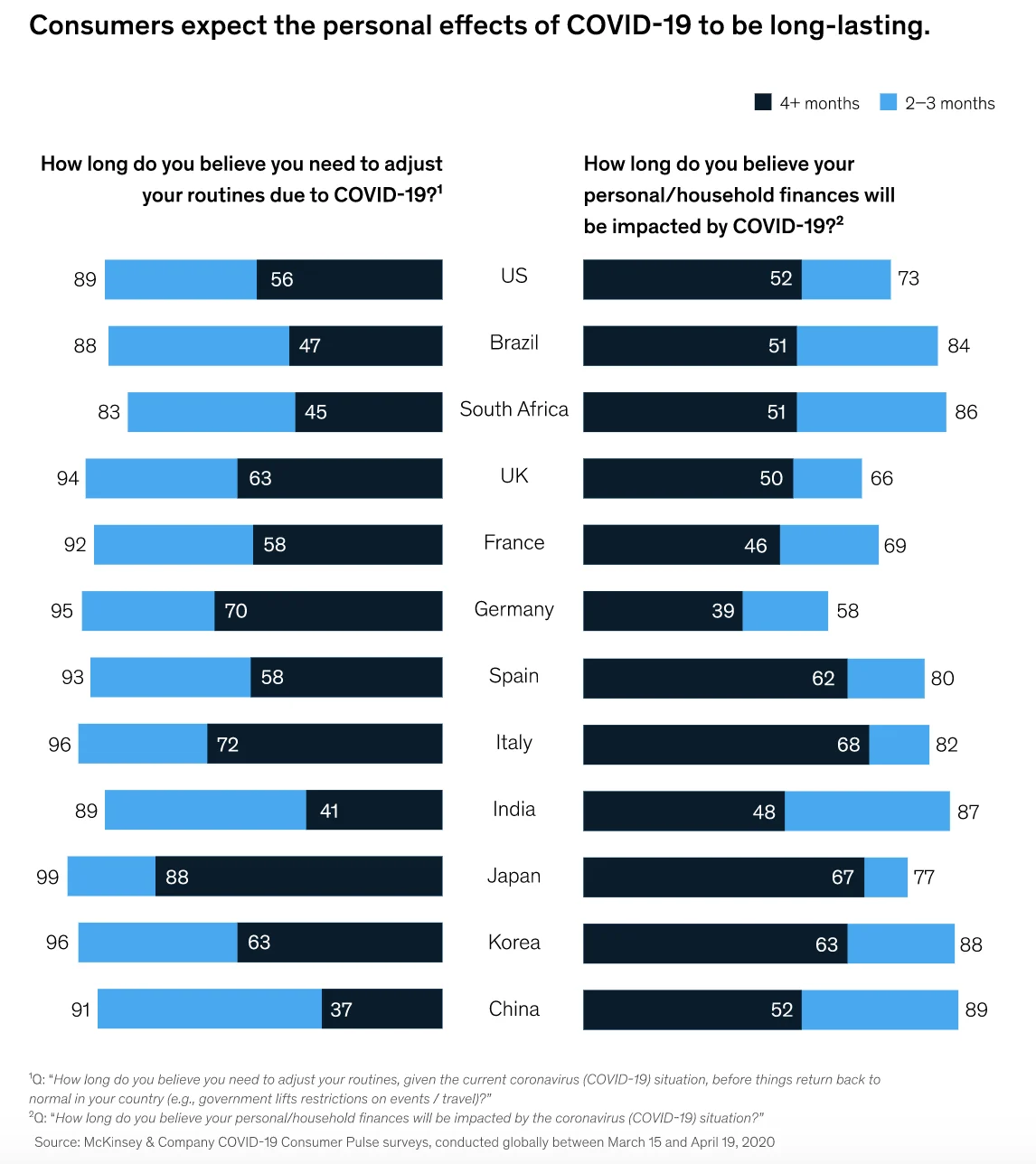

McKinsey also measured sentiment through asking consumers how long they believe they will be personally impacted. In the U.S., a majority of those surveyed believe their routines will find a new normalcy in the next two to three months but predict their finances to be impacted for more than four months.

Source: McKinsey and Company

Retailers Are Feeling the Effects of COVID-19

Change is overwhelming, and retailers are feeling the strain. Just months ago, thousands of retailers gathered at the National Retail Federation conference in New York City to share and learn innovative strategies to fuel growth in a growing retail economy.

Fast forward to May 2020, small businesses to retail powerhouses like Nordstrom, Macy’s, Kohl’s, and Costco, have been forced to create new revenue-generating strategies around the coronavirus pandemic. Whether or not these changes will remain temporary or become part of retail’s new normal is still up in the air.

Delivery service has been a leading focus for many, but a massive hurdle for those with closed distribution centers. In addition, retail employees are not immune to the virus either — leaving retail managers with new challenges, like balancing employee headcount due to more people taking sick leave and protecting employees from the virus by practicing social distancing and using proper personal protection equipment (PPE) like face masks.

These harsh realities have many posing the question, “What is working for retailers?”

Here’s a quick look at what we’re seeing across the retail landscape.

1. Grocery stores.

Consumers aren’t eating less, they’re simply changing where they purchase food and beverages.

That leaves us with one of the few retailers that have seen an increase in foot traffic in the era of coronavirus: grocery stores.

While this may seem like a draw of good luck, grocery stores are being faced with challenges like never before: social distancing and PPE requirements, keeping items in stock amidst panic buying, and fully staffing stores, to name a few.

Grocery store workers have been celebrated around the world as pandemic front liners. But even with a rapidly growing unemployment rate, it’s still difficult to find individuals willing to do the job.

In fact, employees of Target, Whole Foods (and Amazon fulfillment centers), Walmart, and Instacart began scheduling ‘sick out’ rallies in early May. Employees rallied against the allegedly unsafe and unethical working conditions, unpredictable work schedules, and for better health benefits. That said, there is one grocer who leads the industry by example.

Meet H-E-B, a beloved Texas grocery store chain that took an innovative approach to handling the coronavirus pandemic. While no one could quite predict the rush in toilet paper demand, the Texan grocer took active steps to prepare, dating back to January 2020, by communicating with various retailers and suppliers from China, Italy, and Spain to understand their experiences and lessons learned.

With an existing emergency preparedness plan already in place — used in national disasters like Hurricane Harvey — H-E-B was able to adapt and execute quickly.

Justen Noakes, Director of Emergency Preparedness at H-E-B, shared with Texas Monthly, “The most important lesson for us is to listen to what’s going on in our stores. When we started seeing the N95 masks and the sanitizers, we took that as a good sign that our customers were concerned about what was going on, and that’s what really spurred us to activate our program. That’s the biggest one—to make sure that we’re really paying attention to what our customer does, and to actually respond to it. As we continue to maneuver our supply chain and support our stores during COVID-19, we’ll bring some lessons learned and tools out of that into hurricane season.”

H-E-B quickly understood that their customers were relying on them, almost nearly 100%, for their food and beverage needs. When shopping you can expect:

Encouraged social distancing,

Ready-to-cook meals from local restaurants (of whom are making 100% of the profit)

H-E-B curbside delivery, and

Contactless home delivery for senior citizens.

In addition, H-E-B launched their #TexansHelpingTexans social media campaign to promote positivity and support amidst COVID-19. The grocery store also owns food delivery app Favor and is promoting use of the app to encourage customers to support local restaurants — contactless delivery guaranteed. In addition, they are currently offering $5 express delivery on H-E-B orders.

[

View this post on Instagram

](https://www.instagram.com/p/B-NumQpnogW/?utm_source=ig_embed&utm_campaign=loading)

A post shared by H-E-B Grocery (@heb) on Mar 26, 2020 at 3:59pm PDT

2. Convenience retailers.

Convenience retailers like Walgreens and CVS have been deemed essential by the U.S. government — and are on the hunt for employees to staff their retail locations.

The following companies are planning on hiring:

CVS: 50,000 employees (and offering bonuses of up to $500 to eligible employees).

Walmart: 150,000 workers.

Dollar General: Up to 50,000 employees.

7-Eleven: 20,000 new store employees.

Walgreens: 9,500 jobs (and offering bonuses in response to the coronavirus pandemic).

In addition to hiring, c-stores are deeply impacted by the current crude oil crisis. 80% of gas in the United States is sold at a c-store, making current pump prices a real concern for many convenience retailers.

To combat these losses, c-stores have ramped up on products and services that consumers are looking for: food and beverages, health and medical supplies, and curbside delivery.

3. Department retailers.

When it comes to non-essential businesses, keeping sales afloat requires an additional level of creativity.

The harsh truth is that not every business will succeed, especially those who were on the decline before the coronavirus outbreak. This is the case for J.Crew, the first major retailer to file for bankruptcy during the pandemic, who was soon followed by Neiman Marcus.

This leaves questions as to what will happen with retail department stores — a segment that was already struggling prior to the spread of COVID-19.

At the end of April 2020, a combined $12.3 billion was already wiped away from the market caps of J.C. Penney, Nordstrom, Macy’s, and Kohl’s. In addition, Macy’s was dropped from the S&P 500 earlier in the month and replaced by Carrier Global.

The impact of COVID-19 has accelerated the descent of department stores’ reign, but what remains steady is the need for a reimagined customer experience.

Nordstrom has implemented various measures in response to the pandemic, like furloughing the majority of its workforce to cut costs. They also plan to follow Macy’s footsteps and take a phased reopen approach. The new normal will consist of reduced fitting rooms, holding any merchandise that is tried on for 24 hours, plexiglass dividers at checkout, and offering additional curbside pickup.

4. Speciality retailers.

Everything ties back to customer experience, and it’s what specialty retailers need to focus on to stay afloat. Specialty retailers across niches like beauty, home and garden, and auto are tuning into where consumers are spending their time. How can they make their products, services, and brands relevant to consumers at this time? Marketing tactics are arguably more important now than ever before.

The Census Bureau reported a significant, seasonally adjusted, 50.5% decrease in fashion specialty store sales from February to March 2020.

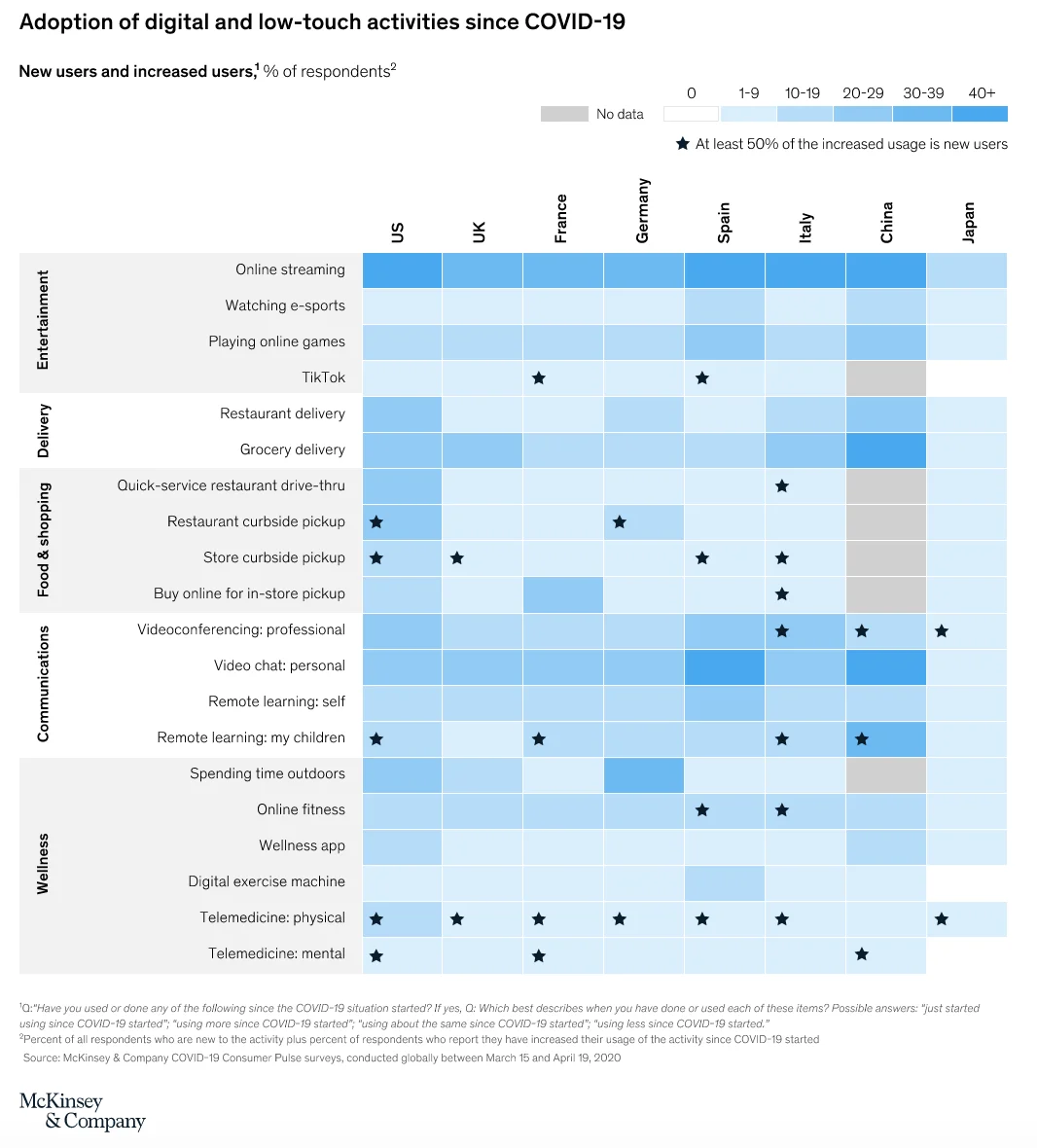

McKinsey and Company recently measured the adoption of digital and low-touch activities amidst COVID-19 around the globe. Store curbside pickup, video chat and conferencing, online fitness and outdoor activities, and telemedicine are a few of the activities U.S. consumers are shifting to. What can specialty retailers do with this information?

Source: McKinsey and Company

Step one is to have an online presence. Specialty retailers with an ecommerce store have an advantage. The industry is seeing more brands move online than ever.

Having an ecommerce website allows your store to stay in business and available to your customers 24/7. In addition, building an online presence opens up more opportunities to sell multi-channel, reaching a larger audience.

[

View this post on Instagram

](https://www.instagram.com/p/B_i3fv9l6ie/?utm_source=ig_embed&utm_campaign=loading)

A post shared by BigCommerce (@bigcommerce) on Apr 28, 2020 at 5:33pm PDT

Second, is to create personalized, relevant content to market your brand and product. If retailers are able to communicate effectively to their customers and engage them, they will win half the battle.

If they can translate that engagement to a convenient online store, they will set themselves up for success. And to go beyond staying afloat, retailers will need to be transparent with their challenges and innovative in their solutions.

In turn, we’ve seen more brands moving to influencer marketing, as many consumers are spending more time on social media (e.g., TikTok) and online streaming platforms. Specialty retailers are now compelled to create relevant, quality content to engage, and ultimately convert, new and existing customers.

“Facebook has seen a 50% increase in messaging, Instagram usage is up 40% and Twitter’s monetizable daily active users has spiked 23%, it seems social is returning to its roots. Social is about the power of human connection.” – Ryan Donovan, CTO at Hootsuite

Preparing For Retail Success In a World Without COVID-19.

The new normal is on the horizon and retailers must reshape their go-to-market strategies if they want to succeed in a world post-coronavirus. Two tactics are clear across any industry vertical: retailers need to be online and they must leverage their digital presence in store.

Here are a few ways retailers can prepare to succeed post-pandemic.

1. Ecommerce sites will become essential.

For retailers without an online presence, there’s no need to sweat. Brick-and-mortars can get online fast with a SaaS platform, like BigCommerce, and easily integrate their point-of-sale system (e.g., Square, Vend, Springboard Retail). But, launching an online store is purely the foundation.

Retailers need to strengthen their ecommerce presence by optimizing the customer experience to find success in a post-pandemic world. In order to do so, they’ll need to focus on:

Search engine optimization (SEO) to rank for top keywords and drive traffic,

Creating personalized, relevant content to engage customers across various marketing channels,

Delivering detailed product information (including high resolution images) and reviews, and

Conversion rate optimization (CRO) strategy to capitalize on increased traffic.

2. Direct-to-consumer grocery will grow.

Did you know that some of the most popular DTC companies, like Warby Parker and Casper, came out of the 2008 recession? The coronavirus pandemic is predicted to have a similar effect — this time on direct-to-consumer grocery.

When looking at CPG sales, food was up 69.5% year-over-year for the week ending April 18.

In contrast to restaurant delivery services like Uber Eats, DTC grocery brands have more control over their supply — especially now, when many restaurants are closed due to government regulations.

As more consumers spend time at home, they are looking for ways to make cooking easier, healthier and simply more convenient. This is why companies like Thrive Market, Hello Fresh, Winc, and Daily Harvest are currently all experiencing a surge in demand.

From accelerated growth to innovative supply chain solutions, these leading DTC grocers are setting the stage for success:

Thrive Market has asked customers to temporarily limit their orders to under $100 in efforts to reduce order cuts, manage supply, and improve the experience — and their customers have been quick to cooperate.

Butcher Box has been transparent with their existing and potential customers by sending frequent updates from their founder. After implementing a waitlist model for new customers due to heightened demand, they are now gradually beginning to welcome those waitlisters.

Winc experienced a week-over-week 49.6% increase in direct-to-consumer sales and 578% increase in new member sign-ups at the end of March 2020.

Daily Harvest’s CEO, Rachel Drori, began doubling up on inventory when news of coronavirus was on the rise, ultimately preparing for a surge in sales in the weeks to come.

Hello Fresh is predicted to make around three quarters of their projected annual profit in the next three months.

3. Payments will become contactless.

Social distancing will likely continue to influence how businesses and consumers interact with one another.

As retailers resume brick-and-mortar functions, the in-store customer experience will be drastically different. Among changes to the shopping experience, one of the most important will be the checkout process.

Payments will become contactless, and methods like Apple Pay will become more prevalent than ever. While this will be an adjustment, contactless payments will make both your retail employees and your customers more comfortable as society transitions to life after the pandemic. Having an integrated POS system across your online and offline stores will help streamline and enable contactless payments.

Also, be sure to notify your customers of any changes to avoid confusion or disappointment when they shop in-store.

4. Checkout-free retail.

To no surprise, Amazon is taking the lead on revolutionary technology to bring us checkout-free retail.

After making headlines back in 2018 with their innovative concept of Amazon Go — a checkout-free grocery store — the ecommerce giant is now extending their ‘Just Walk Out’ technology to retailers.

According to Amazon, “In Just Walk Out__-enabled stores, shoppers enter the store using a credit card. Our Just Walk Out technology detects what products shoppers take from or return to the shelves and keeps track of them in a virtual cart. When done shopping, they can just walk out and their credit card will be charged for the items in their virtual cart. If shoppers need a receipt, they can visit a kiosk in the store and enter their email address. A receipt will be emailed to them for this trip. If they use the same credit card to enter this or any other Just Walk Out-enabled store in the future, a receipt will be emailed to them automatically.”

This retail evolution won’t happen overnight, but it’s certainly intriguing to imagine what a checkout-free retail experience would entail.

5. Curbside pickup and home delivery options.

One of the most popular services we’ve experienced throughout the pandemic: curbside pickup and home delivery.

Consumers are becoming used to the convenience of these services during lockdown. As we transition to a world after the outbreak, retailers will want to optimize these functions.

6. Expansion into automation.

Even before the pandemic broke out, automation was on the rise. Yes, we’re talking about the use of robots to execute on retail operations.

“I strongly believe that the current health crisis will accelerate the adoption of robots in retail.” – Steven Keith Platt, research director for the Retail Analytics Council and adjunct professor at Northwestern University

So far, we’ve seen robots being used for micro-fulfillment, inventory management, or facilities management (e.g., cleaning). Many, however, fear that the increased use of robots and automation will result in fewer job opportunities. Retailers like Walmart say this is not the case nor the intention — rather, they predict introducing automation will eliminate routine tasks and free up more time for employees to merchandise, sell, and offer customer support.

Conclusion

The retail industry has seen a massive shift in just a few weeks due to COVID-19. From consumer behavior and spending patterns to navigating a new normal, retailers must look ahead — and online — to find success.

Innovative supply chain solutions, creative and compelling marketing strategies, and a continuously evolving customer experience will light the path for retailers as they navigate a world after the pandemic.

Looking to get your retail store online quickly? We’ve compiled a few resources to help.

Brett Regan is an experienced writer specializing in SaaS and ecommerce topics, with a strong focus on helping businesses navigate the digital landscape. His work covers a wide range of subjects, from ecommerce strategies to platform solutions and innovations in online retail. With years of expertise, Brett's writing provides valuable insights for businesses looking to grow and succeed in the fast-paced world of ecommerce.