The Impact of The Supreme Court’s Ruling in South Dakota v Wayfair

This week, the Supreme Court issued a long-awaiting ruling in South Dakota v Wayfair, Inc.

Given the interest in this ruling and ongoing debate concerning its impact, we wanted to share our perspective with BigCommerce merchants.

Background

In March 2016, South Dakota passed Senate Bill 106 (S.B. 106), which required sellers of goods or services into South Dakota that exceeded minimum thresholds to collect state sales tax at the time of purchase.

Previously, sales tax collection was only imposed on retailers with a physical presence in the state.

The bill challenged a 1992 ruling, Quill Corporation v. North Dakota, which established that online retailers could only be required to collect state and local sales taxes in jurisdictions where they operated a warehouse or office or had some other physical presence.

South Dakota sought a declaration in state court that the legislation was valid and applied to Wayfair and several other large internet retailers.

Lacking an income tax and heavily reliant on sales tax, South Dakota argued that its inability to tax out-of-state internet retailers cost the state billions of dollars in revenue.

After the trial court and State Supreme Court found the legislation unconstitutional, the Supreme Court of the United States considered South Dakota’s appeal and overruled Quill.

What Changed?

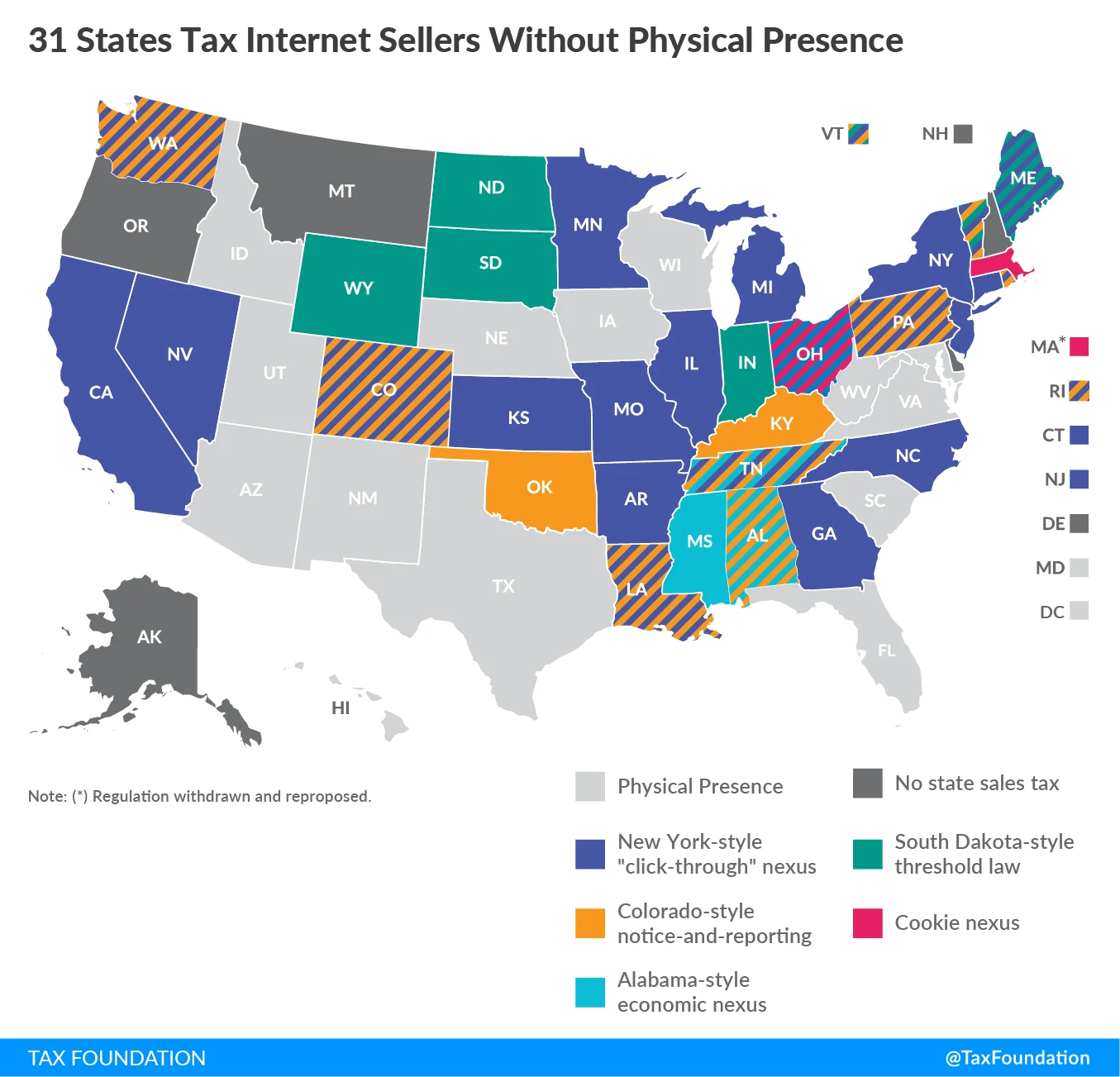

As a result of the Supreme Court ruling on June 21, South Dakota can require internet retailers to collect sales tax on purchases by South Dakota buyers, even if the retailer lacks a physical presence in the state. This precedent establishes a framework for other states to enact or alter laws concerning taxing internet sales. (In fact, 31 states currently have laws that tax internet sales.)

The Government Accountability Office estimates that this decision could generate an incremental $13 billion in state and local tax revenue.

Image Credit: TaxFoundation.org

What Is the Impact on U.S.-based online retailers?

Today, the ruling impacts sales tax requirements only for out-of-state sellers that deliver goods or services into South Dakota with a value greater than $100,000 or engage in 200 or more separate transactions for the delivery of goods or services into South Dakota.

In the near future, however, we expect other states to adopt similar legislation structured to comport with this precedent.

How Will Sales Tax Collection Work Through BigCommerce?

Since 2014, BigCommerce has partnered with sales tax experts such as Avalara, TaxJar and others in order to simplify the burden of sales tax compliance and collection on behalf of our retailers.

Through our integration with Avalara AvaTax, all BigCommerce stores can automatically calculate appropriate sales tax to comply with local, state and federal laws in the U.S. and Canada (merchants collecting sales tax outside of the U.S. or Canada can manually configure these rules in the BigCommerce control panel).

“As we continue to see state and local governments enact different strategies to expand sales tax collection on internet purchases, the complexity of compliance increases for businesses of all sizes,” says, Scott Peterson, Vice President of government affairs and U.S. tax policy at Avalara.

“The South Dakota vs. Wayfair decision means that retailers will need to think about where they sell, not just where they are, when addressing compliance.”

Avalara also provides advanced functionality, such as automated tax remittance, for additional fees. Details about Avalara pricing can be found here. TaxJar also has an integration with BigCommerce available offering similar tax filing services.

We encourage merchants that wish to learn more about how the integration works to read our tax calculation guide.

What Else Should I Know?

It seems likely that other states will seek to pass legislation similar to South Dakota’s S.B. 106 and Congress may consider federal guidelines around state sales tax as well. We expect more activity on these tax fronts in the coming months.

Fear not. Our commitment to BigCommerce merchants is to work tirelessly to simplify the burden of tax collection and compliance through native and tightly-integrated solutions from industry leaders.

Disclaimer: This material is for guidance only and does not constitute legal or professional advice. Always consult a qualified lawyer on any specific legal problem or matter. BigCommerce disclaims any liability with respect to this information.

Jeff Mengoli is the General Counsel at BigCommerce and has represented emerging growth companies for more than 20 years. He received a J.D. from the University of California, Berkeley and an A.B. in economics from Harvard University.