The History and Evolution of Retail Stores: From Mom and Pop to Online Shops

The History and Evolution of Retail Stores: From Mom and Pop to Online Shops

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

For nearly as long as people have existed, they have been sharing, bartering, selling, and consuming resources.

To trace the complete history of commerce back to its inception, we must travel to a time when wooly mammoths still walked the Earth. People exchanged cows and sheep in trade as far back as 9000 BC. The first proper currency extends as far back as 3000 BC in Mesopotamia.

The first retail stores take up the mantle a bit further down the line. By 800 BC in ancient Greece, people had developed markets with merchants selling their wares in the Agora in the city center.

These ruins are of an ancient Greek agora. People would come there not only to shop but to socialize and participate in government.

Flash forward a couple thousand years and we have our modern mammoths: retail giants like Walmart, Costco, and Target.

But what happened in between?

In this deep dive, we’re investigating the evolution of retail and retail shopping in America. We’ll focus primarily on the post-Industrial Revolution era when retail really took off, all the way up to the Digital Revolution and the game changer that is ecommerce.

What is Retail?

First things first. What do we mean when we say retail?

At its simplest definition, retail is the sale of different goods and services to customers with the intention to make a profit.

Retail includes selling through different channels, so items purchased in store and those purchased online both apply.

The definition of retail is expansive enough that it includes the traveling merchants of antiquity all the way to sprawling shopping malls, big-box stores and ecommerce platforms.

Let’s consider how various points on the retail timeline have affected what retail has become, how people shop, and what customers expect today.

The History and Evolution of Retail Stores

We’ve already looked at some of the earliest history of retail — covering hundreds of years of bartering and peddling in a single bound.

However, now let’s look at some (relatively) more recent retail history, how it impacts what we buy and sell, and how we behave today.

1. Mom and Pops: 1700s–1800s.

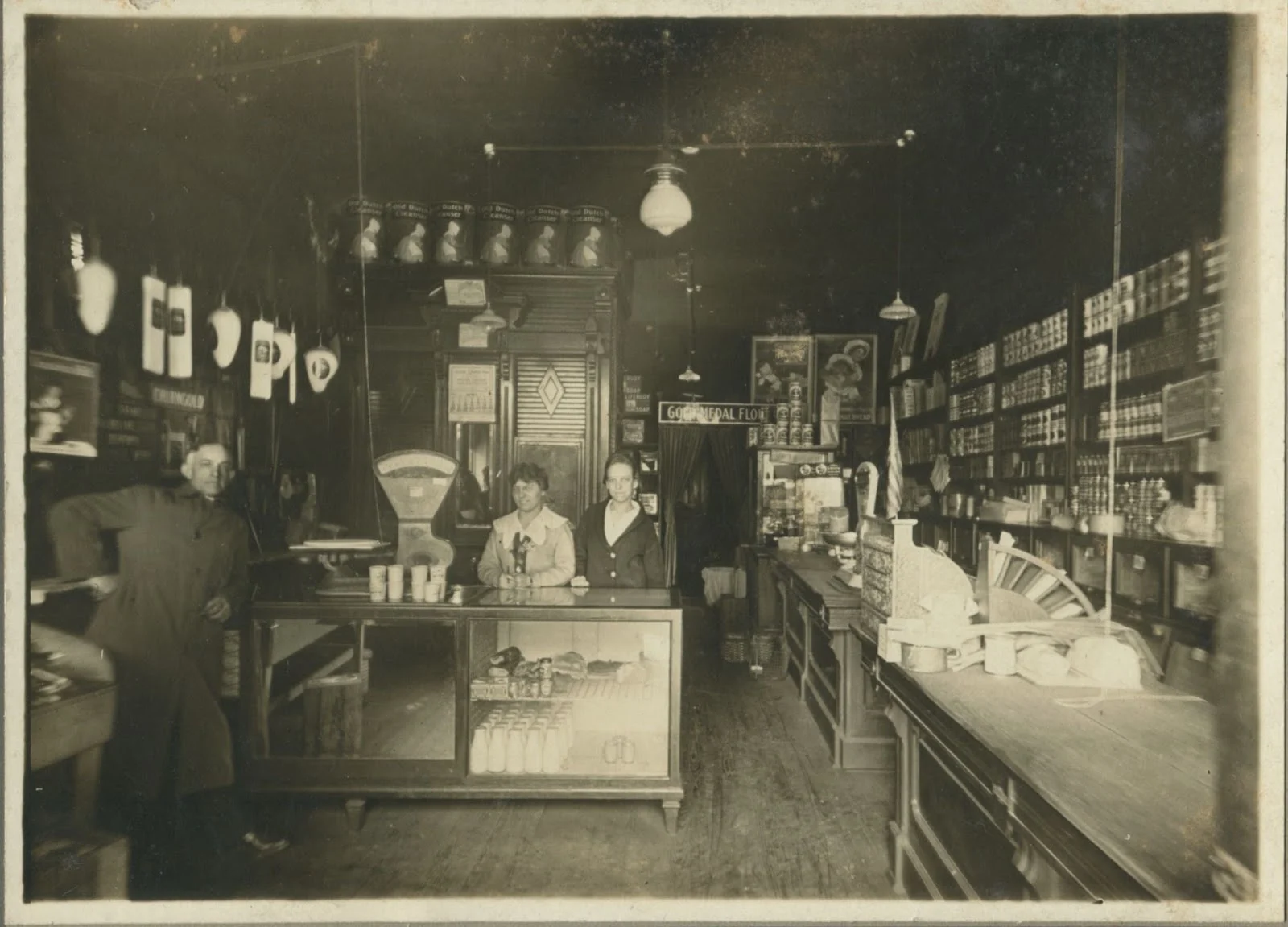

A “mom and pop” store is a colloquial phrase for a small, family-owned, independent business.

In the 18th and 19th centuries, and particularly by the 1880s, these stores were plentiful throughout the United States. Many of these stores were drug stores or general stores selling everything from groceries and fabrics to toys and tools. People during this time were also expanding settlement across the country and creating new towns. It was not uncommon for each town to have a mom and pop store offering general merchandise that could be purchased for daily life.

While these community-anchoring, catch-all stores are less common, family-owned businesses are still out there. Of the nearly 30 million small businesses in America, 19% are family owned and 1.2 million are run by a married couple.

These stores can use the nostalgia factor and capture customers’ desire to support small, family-owned businesses. They can also appeal to customers’ desire for personalization and a fun boutique experience that incorporates human connection.

Today, there is something of a generational divide in how people like to shop. Of Baby Boomers who grew up with brick-and-mortar as their default, 72% primarily shop in-store. This is in contrast to Millennials, 67% of whom shop in online stores.

2. Department stores arrive: Mid 1800s – Early 1900s.

The pioneering spirit of people moving west and both opening and shopping at local general stores evolved as the United States moved into the 20th century.

In the late 19th and early 20th centuries, America’s business and economic sectors changed dramatically. Agriculture — which had previously been the dominant business — was replaced by manufacturing and industry. Oil, steel, textile, and food production in factories brought new jobs and new standards of living.

With more successful and affluent Americans having broader tastes, department stores like Macy’s (1858), Bloomingdales (1861), and Sears (1886) began popping up in cities like New York City and Chicago.

These institutions became fixtures of American life, influencing:

what people bought,

how they furnished their homes, and

what luxuries they felt they needed.

The stores didn’t just sell items. They also provided demonstrations, lectures, and entertainment events that appealed to newly wealthy customers looking for how best to use their disposable income.

Today people are still looking for content and experiences as part of their shopping activities that can help influence what they buy. In 2019, brands are finding success in building strong content- and experience-led commerce experiences.

3. Cha-Ching: 1883.

The first cash register was invented by James Ritty in 1883. Ritty was a saloon keeper in Ohio and nicknamed the invention the “incorruptible cashier.” The machine used metal taps and simple mechanics to record sales. A bell sounded when a sale was completed, leading to the phrase “ringing up” — which we still use today.

This invention went on to spark the ease of customer checkout for over a century, as it was quickly adopted for retail sales.

Prior to this, many businesses had trouble keeping track of their accounting and often didn’t know if they were operating at a profit or a loss. Over time, advances in cash registers have worked to make them more resistant to theft.

Later POS (point of sale) systems have advanced the cash register industry even further by providing computerized cash registers that can keep track of inventory, process credit cards, and provide multiple connected touch-screen terminals in addition to helping to manage profit margins.

As customers are shopping more omnichannel than ever — including shopping from the same merchants both online and in-store — businesses are also seeking methods to combine POS systems and payment gateways so they can keep track of inventory across channels.

4. Credit takes a hold: 1920s.

Just as it’s hard to imagine a store without a cash register, it’s equally hard for many to imagine a time when paying in cash was still king.

In the 1920s, credit cards or “charge cards” began to take hold of the American shopper. However, these early cards were usually issued by hotels or individual businesses and could only be used within their companies. The first universal credit card that could be used at multiple establishment was the Diners Club card in 1950.

The first bank-run credit card was started by Bank of America in 1958. Unlike today, a credit card’s main use was so people didn’t have to travel to a bank and withdraw money to shop. Today it is far more of a bookkeeping/convenience use.

Credit cards are also now much more likely to carry debt as consumers use them to make up for budget shortfalls. According to the Federal Reserve, Americans now have a record $1.09 trillion in credit card debt.

5. Shopping malls: 1950s.

Southdale Center in Edina, Minnesota.

As touched on in the introduction, the concept of malls as central locations where customers can visit multiple merchants has been around since the agoras of Ancient Greece. However, our more modern concept of malls — as physically built shops connected in one location with communal facilities — began in the 20th century.

The first shopping mall was technically an outdoor shopping plaza that opened in 1922 in Kansas City. However, the first indoor shopping mall that mirrored how we think of malls today was opened in 1956 in Edina, Minnesota. Malls were often anchored by a large department store with a cluster of other stores around it.

The growth of these shopping centers was correlated with the growth of automobiles. With cars available to the masses, more people were leaving cities and commuting from the suburbs.

The mall was envisioned as a cultural and social center where people could come together and not only do their shopping but also make an activity of it. By 1960, there were more than 4,500 malls accounting for 14% of all retail sales.

With ecommerce sales growing, the appeal of malls has gradually declined, hitting a 20-year low in sales in 2019. That said, some digitally native brands are still exploring in-person shopping at new mall-type environments. One example is Neighborhood Goods outside of Dallas, Texas, which features a rotating series of pop-up shops from different merchants.

What can we learn from this? While the traditional malls of old are no longer the exciting experience they once were, shoppers still do seek out experiences around shopping both online and offline.

6. Big Box is in: 1960s.

The very first Walmart in Rogers, Arkansas.

While people loved malls for the social aspect and enjoyment of window shopping and moving from store to store, there was also a renewed interest in a return to the one-stop-shop. However, unlike the mom and pop general stores of old, these large stores served bigger populations and provided items cheaply at a much bigger scale.

In 1962 the first Walmart opened its doors in Rogers, Arkansas. Target and Kmart also opened their first stores that same year.

The efficiency and overall size of these indoor giants made them attractive to consumers looking for convenience and friction-free, no frills service. Unlike the department stores of early in the century that provided personalized service and attended to customers’ needs, these large retailers were more focused on self service and providing efficiency.

At these big box stores, customers could find the consumer goods they needed, and at much lower prices. This was made possible by changes in the laws after World War II that paved the way for discount retailing.

Big box stores, and specifically Walmart, are still dominating in the present day. Walmart’s sales in 2018 were over $500 billion, and they’re projected to grow 3.7% in 2019. Other big box retailers are having to get creative to open new stores, revolutionize current stores, and provide more value in the shopping experience to appeal to customer’s increased expectations in an Amazon- and Walmart-dominated world.

7. Ecommerce looms on the horizon: 1990s.

Arguably one of the biggest flashpoints in retail history is the dawn of widespread internet shopping. Amazon was established in 1995 as a simple online bookseller. In 2018, the online retail platform reported a net income over $10 billion dollars.

Clearly, over the past three decades people have jumped onto the ecommerce bandwagon. There are a number of reasons for this. Ecommerce provides convenience and efficiency to the shopping experience and enables shoppers to research, examine reviews, compare prices, and make purchases at all hours of the day.

The growth of ecommerce mirrored the growth of the internet. As more and more people had access to the digital world, they became more interested in shopping there. Initially, some people were skeptical of providing personal data and payment information online, but the development of SSL security protocol in the 1990s helped to assuage those fears.

8. Social media opportunities: 2007.

Facebook, the most successful social media platform ever, has over 60 million active business pages on it. Twitter provides a way for businesses to talk directly to customers, and with Instagram, they can showcase their products in authentic lifestyle situations.

Social media opportunities have been both an opportunity for retail brands to capitalize on and a new challenge for them to conquer. Current projections show that by 2020, 90% of businesses will use social media for a portion of their customer service.

In 2011, Facebook rolled out sponsored stories as a form of early advertising. Marketers could capitalize on the huge amount of data people provide Facebook to target very specific customers. Today, Facebook and Instagram are also channels where brands can sell their products directly.

9. Retail slows while ecommerce grows: Modern day.

This brings us to retail today. Retail sales are growing slowly as a whole. The growth of sales in physical stores in 2018 was merely 3.7%. Meanwhile, ecommerce sales saw a 15% jump. In a decade, ecommerce sales have grown from 5% of the retail market share to nearly 15%.

Customers are hungry for online shopping experiences, but not all ecommerce is created equal. Brands are developing strong multi-channel strategies. Below we’ll look at why some businesses are thriving and others are failing to keep up with modern trends and expectations.

6 Important Retail Statistics

As the above walk through retail history illustrates, many of the changes in retail and ecommerce have both influenced changes in human shopping behavior and subsequently been influenced by these same changes. People’s lifestyles and needs change, and so too do the way they shop and what they choose to buy. These statistics paint a picture of modern retail but can also help modern businesses predict the future of retail.

1. Retail sales hit $6 trillion in 2018.

Those are some big numbers. Retail spending tells us a lot about how consumers are feeling in the economy. Understandably, during recessions, consumer spending goes down and when people are more confident, those numbers go up.

What’s important to remember is that, even with record-high retail spending numbers, not all businesses are seeing a boom. Retailers that aren’t keeping pace with technological innovations and customer experience needs are closing their doors.

2. 77% of shoppers use mobile devices to search for products.

Much as people turned to the general store as they pioneered the west, and flooded suburban malls as fast as their new cars could take them, technology fuels major changes in retail. The proliferation of mobile devices is no exception.

People are increasingly using mobile devices not only purchase items, but research and compare prices. Whether you’re a retail store or an ecommerce shop, this is good news for mobile advertising and a strong reason to have a mobile-optimized site.

3. Retailers spent $23.5 billion on digital ads (just in 2018!).

Per the above, retail marketers are taking note of where customers are now searching for and getting their information… and it’s not from highway billboards and newspaper spreads. In 2018, digital ads made up 70% of retailers’ ad spend. Retailers increased their digital ad spend by almost 19% in just one year.

4. Brick and mortar still owns the retail industry by 4:1.

Physical stores have been a staple of American retail for hundreds of years so, even though ecommerce is growing in influence, it is still not replacing brick and mortar just yet. In fact, brick and mortar still owns (or is projected to own) over 80% of the global retail sales from 2015 to 2021.

Successful ecommerce ventures are finding success in having both an online and physical presence that work together seamlessly. For example, customers could exercise the ability to research online and buy the product in-store or even buy online and pick up in-store.

5. Ecommerce market share is expected to reach 13.7% in 2019.

While people aren’t giving up on in-person shopping and experiences by a longshot, the retail market share for ecommerce is on the rise. It’s growing quickly enough that it is projected to reach 17.5% by 2021. Overall, this offers opportunities to businesses who want to expand online, improve their online experience, or better sync their online and offline channels.

6. 54% of consumers cite being able to shop 24/7 as a primary reason to shop online.

This statistic really gets at the heart of how changing customer behavior and expectations go hand in hand.

Previously, shoppers were excited about department stores that could provide lifestyle advice and personalized shopping experiences. Then they loved malls and came to expect the convenience of all the stores they wanted being in the same location. Finally, the ascension of big box stores gave them the expectation of a one-stop-shop guaranteed to provide steep retail discounts.

Now, they expect all of these things and the ability to have them while sitting in bed on their phones at 3 a.m.

4 Retailers That Stay Ahead of the Curve

As times change, it’s interesting to see which retail brands are able to adapt and thrive and which fall by the wayside. Many of the businesses doing well in the current retail landscape are those that are capitalizing on new technologies or providing a clear customer advantage or experience.

1. Amazon.

Knowing that ecommerce is a growing market, it would be impossible for Amazon — the creator of the most successful ecommerce enterprise in the country — to not be on this list. Each month, over 197 million people globally visit Amazon.com. And in 2018, their U.S. commerce market share was 49%. That equates to a cool 5% of all retail spend in the country.

People flock to Amazon because they can often find lower prices than in stores. Additionally, the free two-day shipping with Amazon Prime has created a whole new standard for shipping speed expectations.

2. Kroger.

Kroger is the leading supermarket operator in the U.S. While their traditional grocery store remains strong with over 3,000 stores and $119 billion in sales in 2018, they have also been making strides in online operations by investing in expanding store pickup locations for online orders and grocery delivery. Other technological advances include a complex mobile app and digitally-enabled shelves that communicate with shoppers through display screens.

3. Walmart.

Walmart still remains the largest retailer, with $387 billion in sales in 2018 across their more than 5,000 stores nationwide. Walmart is continually investing in new technologies, including store-cleaning robots, interactive displays, and artificial intelligence to keep stock levels consistent. Their online Walmart marketplace has also been a huge hit for the ecommerce and online shopping community.

4. Costco.

Costco helped to revolutionize the warehouse membership concept. Their 770 locations don’t have a lot of frills (you won’t find aisle information signs or bags for your items), but what they do provide is low cost and high quality goods. Even when retail is slowing down, Costco stays ahead of the game, coming in with almost $141 billion in sales in 2018 alone, a 9.7% growth from 2017.

3 Retailers Who Fell Behind

Many mall staples like Abercrombie and Fitch and Footlocker closed dozens of stores in 2018. Landmark department store Macy’s is still a cultural beacon, but has itself faced financial uncertainty and 100 store closures over the past couple of years. The following businesses are failing to thrive in the current age of retail.

1. Toys R Us.

One of the saddest moments of the past couple years was Toys R Us’ bankruptcy filing. This was the third largest bankruptcy in U.S. history. The failure of the toy store giant is often attributed to a failure to keep up with consumer behavior. Their stores were stocked with inventory, poorly merchandised, and offered limited customer service. Customers who could easily find inexpensive products online, compare reviews, and price match took their business elsewhere.

2. Sears.

Sears was one of the first department stores that revolutionized the way we shop. The Sears Roebuck mail-order catalogue was once the go-to place for Depression Era Americans to buy everything from watches to homes. Flash forward to 2018 and they are being outpaced and underpriced by online retailers to the point that they filed for bankruptcy. Their more than 400 stores will remain open, but they continue to face challenges.

3. Victoria’s Secret

This once-popular underwear brand has seen its numbers continue to fall in recent years. They closed 20 stores in 2018 and continue to face an uphill climb. Part of the problem is a failure for their brand to resonate with today’s shoppers, as well as increased competition from digitally native vertical brands like ThirdLove and Walmart-owned Bare Necessities.

The Ecommerce Effect on Retail

Ecommerce is obviously having a huge impact on the current and future face of retail. Whether having to adapt to online competitors or updating their digital brand presence, businesses that are doing well are taking note of the following trends.

1. Customers shop for everything online.

More than ever, the ease and convenience of shopping online has become attractive to American consumers. For example, 22% of total apparel sales took place online in 2018, along with 30% of electronics. It is estimated that 20% of grocery sales will take place online by 2020. This has forced companies like Kroger and Walmart to move resources over to an online space, and has helped Amazon continue to dominate.

2. 79% of U.S. consumers shop online, compared to 22% in 2000.

Almost ⅘ of Americans shop online, a 5x boost from the beginning of the 2000s. If your store isn’t online, you’ll suffer the consequences. The companies who have chosen brick and mortar AND online options are the ones that have grown.

3. Ecommerce pushed businesses online, but not completely.

The need to walk into a store and feel the products you’re purchasing is still relevant. Many people prefer to buy the bulk of their goods at the store, and only buy specific goods online. Brick-and-mortar shopping isn’t going away, but ecommerce has made itself an important complementary experience for shoppers.

Conclusion

We’ve come a long way as a species from the simple days of, “Take this cow in exchange for this bushel of wheat.” Customers expect more and more from retailers as time goes on. They want personalized experiences, but also convenience and efficiency. They want discount pricing and fast shipping, but are also willing to pay more for brands they connect with.

As retailers continue to morph and evolve to meet these expectations, they in turn drive new customer behaviors and usher in the next era of our retail history.

Brett Regan is an experienced writer specializing in SaaS and ecommerce topics, with a strong focus on helping businesses navigate the digital landscape. His work covers a wide range of subjects, from ecommerce strategies to platform solutions and innovations in online retail. With years of expertise, Brett's writing provides valuable insights for businesses looking to grow and succeed in the fast-paced world of ecommerce.